An excise tax is an indirect tax charged for certain products such as tobacco, fuel, and alcohol. These taxes are usually levied on the wholesaler of the products. Depending upon the type of tax and jurisdiction, they may be levied on purchases by the wholesaler or on sales made to retailers. Tariffs are special indirect taxes that are charged on purchases of products from other countries. In this article, we will discuss how to calculate, track and pay these taxes in ManageMore Business Software.

Step 1 – Set Up the Indirect Tax

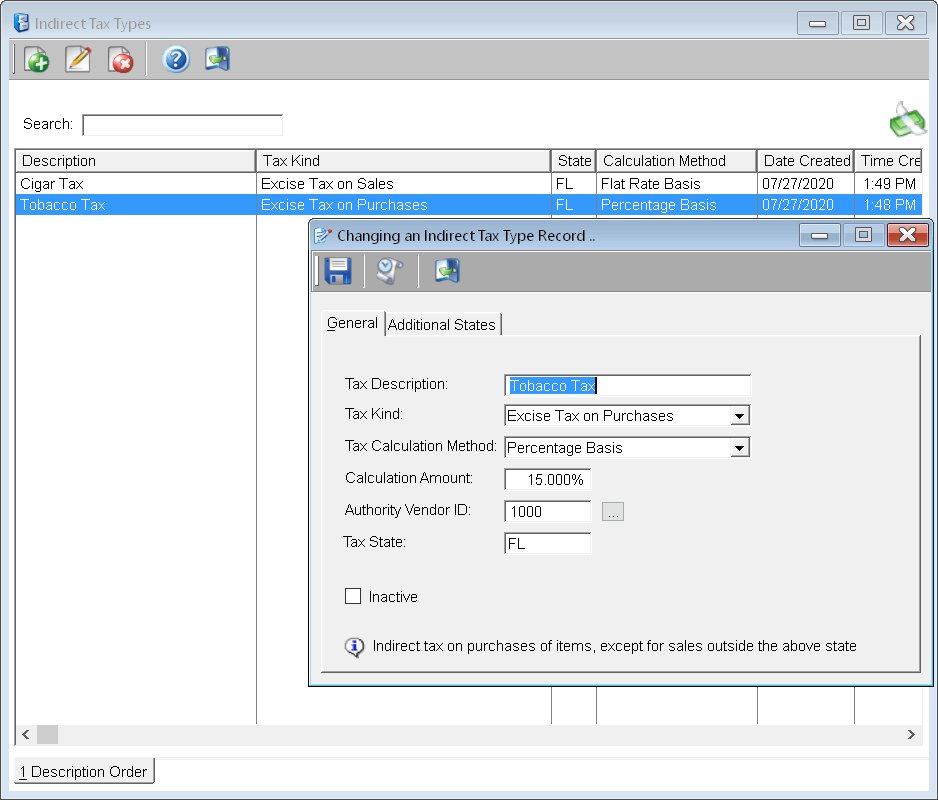

To set up your excise tax or tariff, select List … Transaction Related … Indirect Tax Types. Click the “New Record” button to add a new indirect tax type. Give the tax a description. This is usually related to the type of product being taxed, such as “Tobacco Tax.” Choose whether this is an Excise Tax on Purchases, an Excise Tax on Sales, or a Tariff on Purchases. The difference is explained below:

Excise Tax on Purchases – tax is levied on purchases made in your state, and reduced by sales to other states.

Excise Tax on Sales – tax is levied on sales based on the state where the product is sold

Tariff on Purchases – this is a special indirect tax that is levied on purchases, regardless of where the product is sold.

Next, choose the calculation method for this tax. It can be a percentage of the cost, a flat rate (times quantity), or a rate based on the Net Weight, or Tax Unit 1, 2, or 3 of the item. Enter the appropriate rate.

Then, enter the Vendor Id for the taxing authority that is paid for this tax. Finally, provide the state, if this is an Excise Tax.

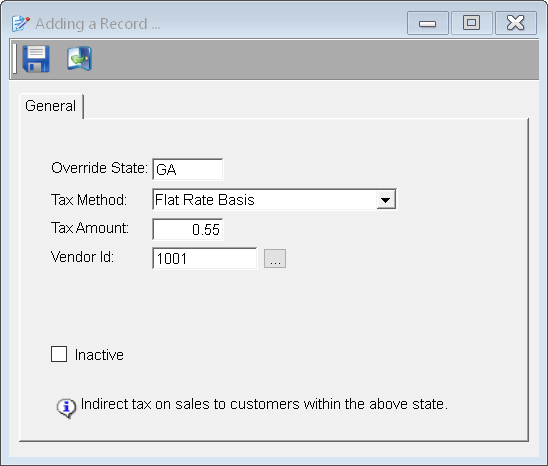

Step 2 – Set Up Additional States

If this is an Excise Tax that is also paid on sales to other states, you will need to set up each of the states you sell to in this step. Select the Additional States tab in the Indirect Tax setup. Then click the “New” button to add a state. Provide the state, calculation method, and vendor id as previously explained. If a sale is made to a state that is not provided, no excise tax will be calculated for that sale.

Step 3 – Assign the Indirect Tax to Items

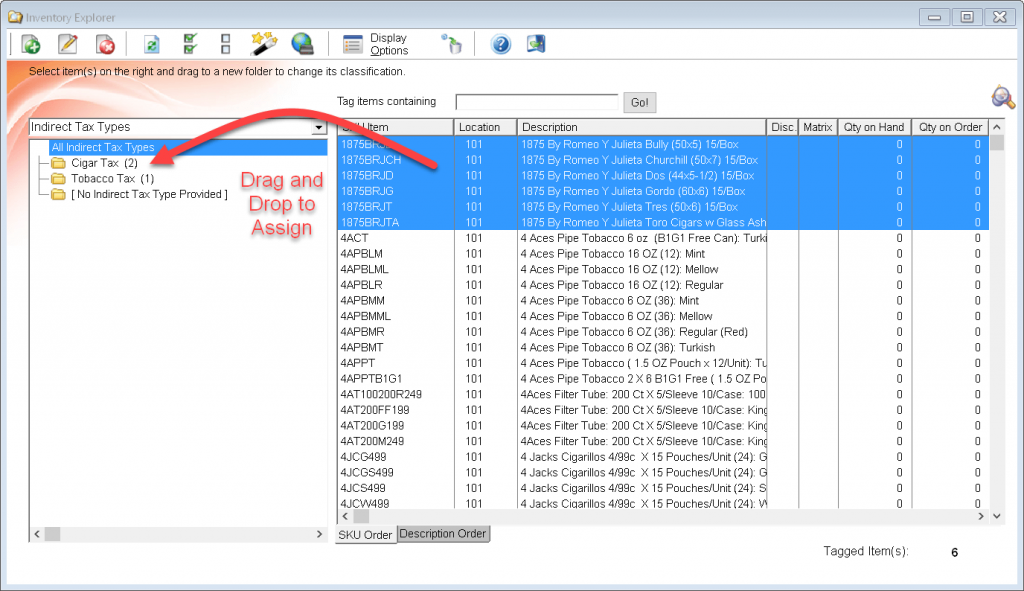

Assigning which items are affected by this indirect tax, can be done by either:

Edit the item. On the Taxes tab in the item, select the Indirect Tax Type

Use the Inventory Explorer. Select Indirect Tax Type in the upper left corner. Select the item(s) you wish to assign. Drag and drop the item(s) to the folder which represents the Indirect Tax Type you wish to assign.

Step 4 – Enter Transactions

As you enter purchases and sales of items in ManageMore, the program will calculate the indirect taxes for the transactions. For excise tax on purchases, the amount of the tax will be shown on the bottom of the transaction for informational purposes.

If you are using the General Ledger feature, ManageMore will automatically record the liability and cost associated to the indirect tax, based on your GL Posting setup. This can be found under Setup … Application … Accounts Payable … GL Posting.

Step 5 – Pay Indirect Taxes

To record a payment or bill for indirect taxes, you will need to run the Pay Company Taxes wizard. Select Activities … Company … Pay Company Taxes.

Select “Indirect Tax” as the Levy Type. Select the Indirect Tax Type and state for which you will be recording a payment or bill. Click the “Next” button.

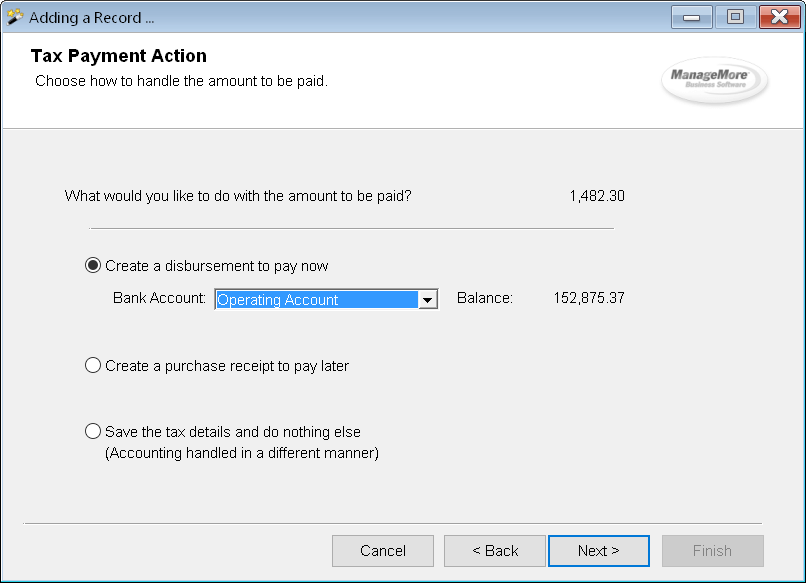

Select the date range that you will be paying. Click the “Next” button. The system will calculate the amount to pay based on the transactions entered during the date range provided. You will see a summary of the amount computed. Click “Next” to proceed.

Select whether you will be creating a disbursement to pay the amount immediately or creating a bill to pay later. Click “Next” and the system will create the transaction for review. Once the transaction is saved, the transactions are marked, and you can generate a report to assist you in preparing filing documents.